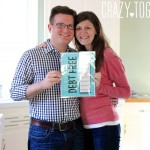

Let me tell you something: paying off my student loans was a huge weight off of Maria’s and my shoulders. It was our overriding financial goal for almost our entire relationship. We weren’t saving any money and we kept our discretionary expenses in our monthly budget to a minimum; everything just went towards the debt. We were ecstatic when we could finally declare ourselves to be debt-free.

Well, now that we have the debt paid off, we wanted to share our new financial goals with you and how our monthly budget has changed to meet those goals. Just because we paid off the debt doesn’t mean we’re done budgeting; we just have new priorities.

Back to the Baby Steps

Like we’ve mentioned before, Maria and I plan our budgets monthly. At the end of July, we realized that we would be paying off the loans for good in August. It was a wonderful feeling, but then we realized that we would need to change our budget. Our first step: pulling out Dave Ramsey’s Baby Steps to see where we were and where we needed to go.

Baby Step 3: 3-6 Months of Expenses

This Baby Step is an expanded version of the $1,000 emergency fund in Baby Step 1, but for much more major emergencies like a job loss or a medical setback. Maria already had 3-6 months of her own expenses saved before I came along. We kept her emergency fund in place while we worked to pay off my student loans.

Obviously, our expenses as a couple were higher than Maria’s expenses as a single woman, so our next financial goal was to fully fund our savings to support both of us in an emergency. We decided to take all the money we received from our wedding and put that money into our savings for 3-6 months of expenses. Once that was all said and done, we had exactly 6 months of expenses set aside. So that was Baby Step 3 completed in no time!

Baby Steps 4, 5 and 6: Simultaneous Steps

If you watch Financial Peace University, you’ll learn that several of the Baby Steps are goals you work on simultaneously.

The Baby Steps that work in unison are:

- Baby Step 4: Invest 15% of all Household Income for retirement savings

- Baby Step 5: College Funding for Children

- Baby Step 6: Pay off the Home Early

When you think about it, those steps are things that can take a long time, so of course you’ll be doing them all at the same time. For Baby Step 4, you save 15% of your income for retirement until you retire. So, obviously that is a long term project; it takes a lifetime. Same with saving up for your children’s college education or paying off the house; they are projects that take a long time.

Here’s a look at how Maria and I are currently tackling those simultaneous baby steps in our household.

Baby Step 4: Invest 15% of Household Income

It’s easy to calculate how much you need to save: just take your income and multiply it by 15%. As part of our normal budgeting process, the second thing we do (after setting our monthly church donation) is making sure we set aside at least 15% of our monthly income for retirement. I say at least because we have the savings automatically deducted and sometimes the deduction is more than 15% of our monthly income.

The hard part of saving for retirement is actually investing it in the financial market. Maria and I use a financial planner to invest that money for us since we are not very financially sophisticated. I think it’s the easiest and best way to go about investing your retirement money, so I strongly recommend that you consult a financial planner. If you decide you want to go your own way, you should look into whether your employer has a 401(k) plan and/or look into setting up a Roth IRA. Both have different advantages and drawbacks, so you should think about them carefully before deciding which (or both) to go with.

Baby Step 5: College Savings

This one is pretty straightforward for us: we don’t have kids, so we aren’t saving for college yet. Once we do have kids, that is when we will start saving. So this one is on hold for us for now. But if you have kids and need to save, you should look into a 529 Plan or an Education Savings Account to get started.

Baby Step 6: Pay Off the House

You probably already knew this, but we don’t own a house right now. Instead, Maria and I are renting a condo while we save up for a down payment on our first house together. Some of the design choices in our condo (like brown carpet and brass light fixtures) are not items we would have selected ourselves, but saving is the name of the game and this is a sacrifice we make so we can eventually afford the home of our dreams.

Even though we don’t own a house yet, we are already devising a plan to pay it off. The more money we save now, the less we have to pay on the house when we buy it. A few weeks ago, Maria and I had a conversation about our goals for the next five and ten years and we set paying off our house as a ten year goal.

As for how we save for our house, we treat it like my student loans, minus the retirement savings. Every dollar we have leftover after setting our monthly expenses and setting aside money for our sinking funds, we put into our home downpayment sinking fund. We set a goal for the amount we want to save and, once we’ve reached that goal, we’ll buy our house!

Maria and I have a long way to go on our financial goals, but we keep plugging away at them, every day, every month, every year. In Financial Peace University, Dave Ramsey talks about gazelle-like intensity to meet your financial goals. We intend to keep our gazelle-like intensity going so that we meet every single one of our goals.

With Christmas shopping going on and New Years resolutions right around the corner, there is no time like the present for you and yours to start on your own financial goals. You might want to begin by purchasing the Financial Peace University Home Study Kit so you and your spouse can get to work the right way on your own financial goals. You can also prepare a monthly budget with your spouse right now. We have a downloadable budget template you can use to get started. And if you are working on your own debt-free journey, we have a fantastic customizable “On Our Way to Debt Free” chart to help track your progress. Just enter your email below to have the chart sent right to your inbox.

Let us know how your financial journey is going. We love hearing from all of you about your journeys out of debt and into financial peace, so please tell us about it!

Our Debt Free Story

We shared all of the details from our story of going debt free on the blog in a series of updates and proudly did a Debt Free Scream on the Dave Ramsey show on February 15, 2016.

You can read more about our journey out of debt by clicking any of the images below.