Now that New Year’s Day is almost upon us, it’s time to start thinking about goals for 2015. Maria tells me that a lot of people are doing an nutrition challenge called the Whole30 for the month of January as a New Year’s resolution. I wanted to suggest another New Year’s resolution: creating a monthly budget every month.

I know many of you have been interested in our posts about Dave Ramsey and Maria’s and my plan to get out of debt. Let me tell you this: the monthly budget is central to both Dave Ramsey’s Baby Steps and Maria’s and my plan. It is the tool that allows us to tell our money how it will work for us.

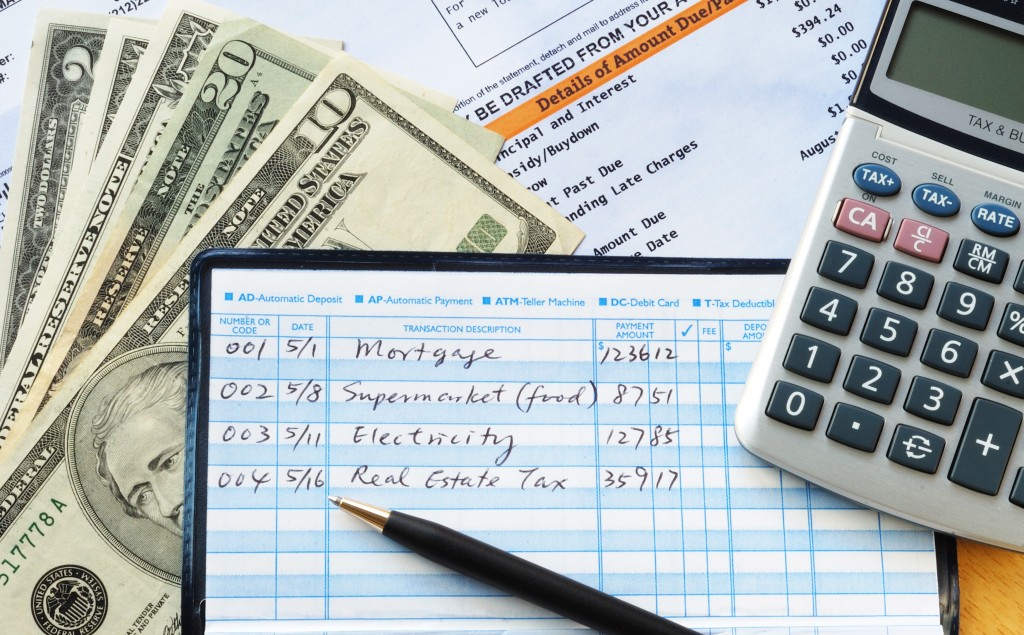

The budgeting process is pretty straightforward. You sit down with your spouse or significant other, estimate how much you will receive in income for the coming month, and then allocate that money to expenses or savings. For example, I budget the amounts for my mortgage, food, gasoline, debt payments, and my savings funds, among many other things. The income should equal the total of the amounts spent or put into savings. That way, you are sure that you are not spending more than you earn.

If you are having trouble figuring out all the categories of expenses or the amounts you should allocate, Dave has budgeting forms with suggested percentages for free on his website here. Dave’s budget forms are helpful, but Maria and I prefer to do our budgets on our ever-present laptops. Maria actually created a form version of her monthly budget spreadsheet, which you can download for free here.

Once you create your budget, you then need to check yourself against it to keep your spending in check and to make adjustments if necessary so that you do not spend more than you earn. And then at the end of the month, make a new budget for the coming month. It takes a lot of effort at the start, but, once you get into the habit, it’s really easy and actually enjoyable to see your savings go up and expenses go down.

There’s no time like the New Year to start budgeting properly and earning that empowered feeling of telling your money to do what you want. Happy New Year, everyone!