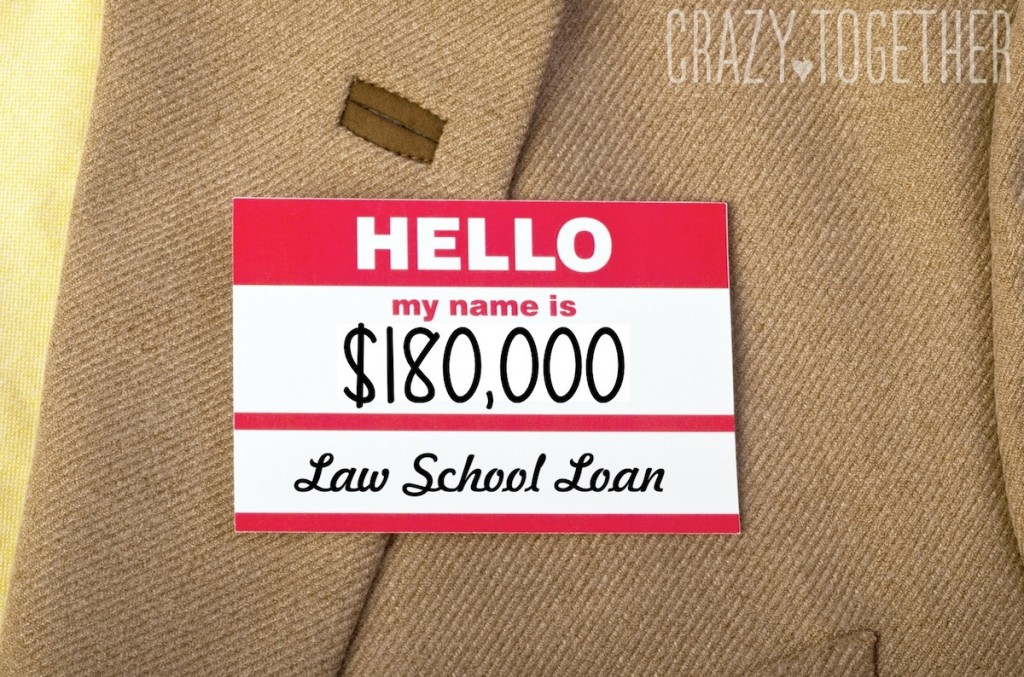

My name is Rob and I have a secret. I’ll give you a hint: it rhymes with “schmudent roans.” Yes, like many, many Americans, I have student loans. And not only do I have student loans, I have a massive amount of student loans.

Want to know how much? I’ll let you guess. I went to a private Catholic law school in Chicago. In addition to my tuition, I paid for my books, apartment and food with my loans, as well.

The answer is $180,000. That’s one hundred and eighty thousand dollars. It’s a staggering amount. My minimum monthly payments on my student loans are almost double my monthly mortgage payment, my monthly homeowners insurance payment and my monthly property taxes combined.

What’s crazy is how shockingly easy it was for me to accumulate such a massive amount of debt. I’m not going to focus on the craziness of higher education lending practices in America; plenty of other people have done that. Instead, I just wanted to introduce you to the idea of my debt. There will be many more posts going forward about repaying my debt, how it affects my relationship with Maria and how we plan to address it in the course of our relationship.

When I decided to go to law school, I had no money or resources. I had just graduated with my undergraduate degree (which my parents paid for; a luxury that many people do not have) and decided that, rather than working for a few years to save a bit and then continuing to work through law school to help pay for it, I would just get some loans and go to school. It’s what everyone was doing. Loans were freely available. I just filled out some forms and I was off to the races. And everyone else was doing it, too. How bad could it be?

Well, I guess in my case, it wasn’t as bad as it could have been (or is for many people). I am one of the lucky ones, though. I have a good, steady job. In the long run, it would have taken me 25 to 30 years to pay off my loans and I would have a lot less in savings for retirement, so I would have had to work for a long, long time. But a lot of people are not that blessed. Some people aren’t able to make the minimum payments and have interest accruing like crazy while they are still unable to find steady work.

By the time I met Maria, my loans had become a part of me. I had plenty of sleepless nights back in law school over my loans, but I graduated law school in 2008. Maria and I first met in 2013. I’d had over 5 years to get used to them. Maria did not. She knew I had some debt, but did not really find out how much I owed until we had been dating for a while. At first she was shocked. As we grew closer and realized that we were in love, it bothered her more. I knew it was a lot of debt, but it took me quite a while just to realize how much it bothered her.

In the meantime, if you are working on your own debt-free journey, you can download our free On Our Way to Debt Free chart to help you track your progress. Maria made it highly customizable so you can tailor it to your own situation. Just click on the image below to download it!

Update: We Did It!

Since I published this post, Maria and I have successfully completed our debt plan and are completely, 100% debt free! It’s been a crazy journey, but we did it together. To celebrate our freedom from student loans, Maria and I headed down to Nashville to a Debt Free Scream on The Dave Ramsey Show. You can read all about our Scream and how we got to meet the man himself Dave Ramsey in this blog post.

Our Debt Free Journey

You can read all about our plan to pay off my student loans and how we worked through the journey together by clicking on the links below.

This is an awesome topic!! Most people never share this information with their partner until well into the marriage.. This is definitely an awesome subject, and hopefully your awesome courage and transparency has helped someone out.. You guys are awesome!!!

Thanks! I really appreciate your kind words! The subject of debt has been a bit of a learning process for me. But I’ve always felt that being open with your significant other was one of the keys to a long-lasting relationship, so when Maria and I reached a point that it was clear we could be long-term, I made sure she knew about the loans. Money is a huge source of potential conflict that is easily avoided if you are both on the same page. Thanks again!

Debt is a tough topic, but so important to discuss and learn to be open about (with a partner/spouse)! Financial Peace University is an AWESOME program! My husband and I have taken the class twice now (once while engaged… helped us plan a wedding DEBT FREE) and again after we were married (so we could focus on getting out of debt). Talking about finances still is tough for me, but it is helping us get out of debt!!! I’m excited to read more! :)

Hi Bonnie! Beating debt is an uphill battle, but it’s a GOOD fight. We are so excited to share our journey out of debt on the blog and inspire others to do the same. Thank you for following. xoxo

We took the FP plunge several years ago. With 6 kids, a couple with special needs that required expensive treatment, and a house that gave us an unwelcome surprise need to rebuild a good portion, we were drowning in debt. We did the laser focus, sold everything we could part with (including a car – no more car loans!), and in 2 years we had everything but the house paid off.

What I thought would feel constraining (budget every single penny), was actually empowering. Once we started giving ourselves a regular weekly allowance, we stopped spending money on frivolous things. It was a strange and surprising outcome that having money made us hesitant to spend it!

In another couple years we should have the house paid off. Then we will be truly free!

You’ll never regret doing FP full in. You’ll be free of the debt sooner, surprised how quickly you are able to pay it off, and you’ll never want to go back.

WOW! That’s amazing! Congratulations! Maria would tell you that you should call in to Dave’s show with a fantastic story like that.

And I agree 100% on the empowering part! I used to spend money without really thinking about it and it felt fantastic to tell my money to work for me. I’m really looking forward to getting our lives in order the way we want them to be.

I can’t wait to read more about this!! The debt my husband and I have on college loans is rediculous. About $140,000 and I am a teacher and my husband is a nurse. I feel like there is no end in sight…ever!

Thanks! I look forward to sharing our story and, hopefully, pointing some people in the right direction. It does just feel like your swimming in an endless ocean, but there’s always a path to a debt-free end. It just takes focus, dedication and work.

My husband and I have been married 25 years. We took the Financial Peace class 3 years ago and it changed our lives! You and Maria will be so blessed by this class. If we had learned these things early in our married lives, things would be so different! We are now debt free, except for the house, and are trying to play catch up in regards to our retirement. Our daughter went through Financial Peace as a high schooler and we pray that her financial life will be so much better than ours. You will NOT regret taking that class! God’s blessings to you both.

Hi Laurie,

Thank you so much for your sweet and encouraging words. Rob and I talk all the time about the legacy we want to leave behind for our children. One step at a time, we will get to a debt free life, fully-funded college savings, a secure retirement and a life of generous giving. Baby steps!

I am certain that your daughter is on the right path as well. The example you set as a parent leaves such a deep and lasting impact on her financial responsibility.

Congratulations to you and your sweet fiancé! This is a battle that YES, you face TOGETHER. My husband and I both put ourselves through school. He too has multiple degrees and I went to a private Christian school, yet neither of us have the occupations that pay us what our educations are worth- Pastor and a Teacher. When we married almost 8 years ago we had over $125k worth of debt. On top of the debt, I married a man who loved to spend money (ok, I did too but I am the responsible one, so my love of spending died quickly). Unfortunately we did not tackle this head on as you two are, we also got married when our loans were still in deferment, which means we were both unaware of how much we really had loaned (you know, a little here, a little there) mixed with a little denial. We had no idea how much debt we individually had or collectively had. If only we had done FPU in premarital counseling- we now require it of couples we mentor and aim as many of our college students to Dave! The past three years we have been very serious about tackling our debt, baby steps and lots of snowballing. One of my favorite go to lines for my spender has been “what would Dave say”, ha, gets him everyone. This month we just made our LAST payment on our last loan. What an incredible relief and insane blessing from the Lord! I also gained a husband who is now excited to see how much money we can save and not always spend (don’t get me wrong, he still loves to spend…. his budgeted dollars). I too accepted our loans as a part of who we would always be, thankful there was another way. I commend you both for walking this journey together prior to marriage and for you being open and honest with her. What a beautiful foundation you two start your marriage on!! Congratulations! I look forward to seeing how you two grow and edify one another through this journey.

Thank you very much and congratulations! Watching FPU was totally Maria’s idea (as are many of the good ideas in our relationship ;-) ), but I feel very strongly that it was the best thing we could have done and we are so much stronger as a couple for doing so. We are always 100% on the same page when it comes to finances, which takes away one HUGE potential source of stress in our lives, especially as we get started on our journey together in marriage. I’m so happy you and your husband have gotten to the point you have! Talk about gazelle intensity! I look forward to sharing more about our lives, too!