My name is Maria and I fell in love with a man who owes $180,000 in student loans. His name is Rob. You probably met him already. We are getting married and on June 12, 2015; I will also find myself $180,000 in debt.

For richer or for poorer. For better or for worse.

I am currently debt-free and have been for several years. After I graduated from college, I found a job at the Catholic School I attended as a child. Like most private schools, the salary at my school was low. Really low. So I lived at home for a few years while I paid my way through grad school, paid off my car (the first and last item I have ever financed) and allowed myself one additional year at home to save. I knew that an apartment with basic furnishings would be expensive and I wanted to pay for all of it up front. Money was tight and there was no room in the budget for monthly finance payments.

It was during that final year at home that a wise friend told me about Dave Ramsey and lent me her collection of DVDs from Financial Peace University (also known as FPU). At the time, the course was 14 lessons long and it laid out 7 “Baby Steps” toward financial success. I absorbed every single segment of the program, took copious notes and formulated a lifelong plan for my finances.

For the past seven years I have been making my way through the baby steps and made it all the way through Baby Step 4 (Invest 15% of household income into Roth IRAs and pre-tax retirement). I have even been saving for a house. Back when I first moved out on my own, there were only a few extra dollars in the budget for my house savings. Some months, I would just be able to put $20 aside for my future home. But I kept on trucking and saving.

Then Rob came along. He told me right away about his student loan debt. I chose not to listen carefully or dwell on it because in the early months of our relationship, it didn’t really seem like any of my business. As we became more serious, I started listening. When we began to talk about marriage, I took deep breaths. I WAS ON BABY STEP #4! Rob had unwittingly done baby step 1 (save $1,000 for an emergency), but it was pretty much by accident. There’s a lot of hard work between baby step 1 and baby step 4. Despite being on his way, Rob was still SO far behind.

Fortunately, Rob is a wonderful man and he is financially responsible. He paid off his car last year and doesn’t even own a credit card. On top of that, he actually loves number crunching and doing accounting. He just made a series of foolish choices in the past. I had mentioned Dave Ramsey’s FPU program a few times to Rob while we were dating, and he was very receptive to anyone that helps people get out from under a mountain of debt.

Once we were engaged, Rob and I decided to invest in our future and purchase the Financeial Peace University Home Study Kit. The program is intended to be a nine-week course but we were so eager to get on track and figure out how to get on solid financial footing, we completed the entire course in 3 weeks. We watched all of the videos, read the entire book and had many long and serious discussions about money.

I also cried a few times during those three weeks. There was one particularly upsetting weekend where I cried several times. It was bad. And Rob felt awful. Before taking the program, Rob and I had big plans for where we would live after marriage. We were going to purchase the house of our dreams. After all, I had been saving for SEVEN years. Dave Ramsey’s lesson on home buying made us realize that we are not financially prepared to purchase a new house. That entire plan became halted this summer and it was a tremendous disappointment for me.

After Rob and I reformulated our financial plan, a good friend of mine asked how I felt about the situation. She very sincerely wondered if it bothered me to see all of my hard-earned savings suddenly re-allocated to paying off Rob’s debt. Strangely, the answer was “no.” It doesn’t bother me. I don’t hold Rob’s choices from the past against the man he is today, I choose not to dwell on the past because it is beyond my control. Rather than feeling disgruntled or upset, I actually feel tremendously blessed. I am thankful that Rob was so receptive and willing to create a financial plan with me. He could have become defensive. Goodness knows, I probably would have if the situation were reversed. God has given us the talents, tools and resources to pull ourselves out of student loan debt and we shall overcome. Together, of course.

So how exactly do two people pay off $180,000 in student loan debt? We have big plans and we can’t wait to share them with you. You have heard Rob’s story and my story. Next time around we will share OUR story for the future.

Need some help tracking your own debt-free journey? I made a free customizable chart that you can use to track your progress – just enter your email below and it will be sent right to your inbox.

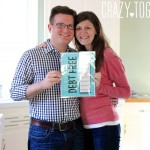

Update: We Are Debt Free!

Rob and I worked very hard in the time since this post was originally published and have paid off his student loans! The journey required both of us to sacrifice, but we are now moving forward with our lives without any debt dragging us down. To celebrate, we drove down to Nashville to do a Debt Free Scream on The Dave Ramsey Show, which you can read all about in this blog post.

Our Debt Free Journey

If you want to learn about our plan to pay off Rob’s debt and how we did it, click on the blog posts below to read about it.