Maria and I have talked a lot about our debt and how Dave Ramsey and Financial Peace University helped us put together our plan to get out of debt and manage our money together. But we have not really talked about what Financial Peace University is or why we love it so much.

Before I tell you all about Financial Peace University (FPU) and Dave Ramsey, it’s important to note that Maria and I do not profit in any way from sharing this information. We are not affiliates of FPU (I’m pretty sure Dave Ramsey does not even have an affiliate program) and we are not compensated to advertise for him. Rather, it’s a program we believe in. Dave Ramsey’s principles have already made our relationship stronger and we believe his message is worth the time and energy to share with everyone we know.

What Is Financial Peace University

It’s a series of lectures, basically. Dave Ramsey is quite an engaging speaker and he coaches you through the very practical things you need to know in managing money.

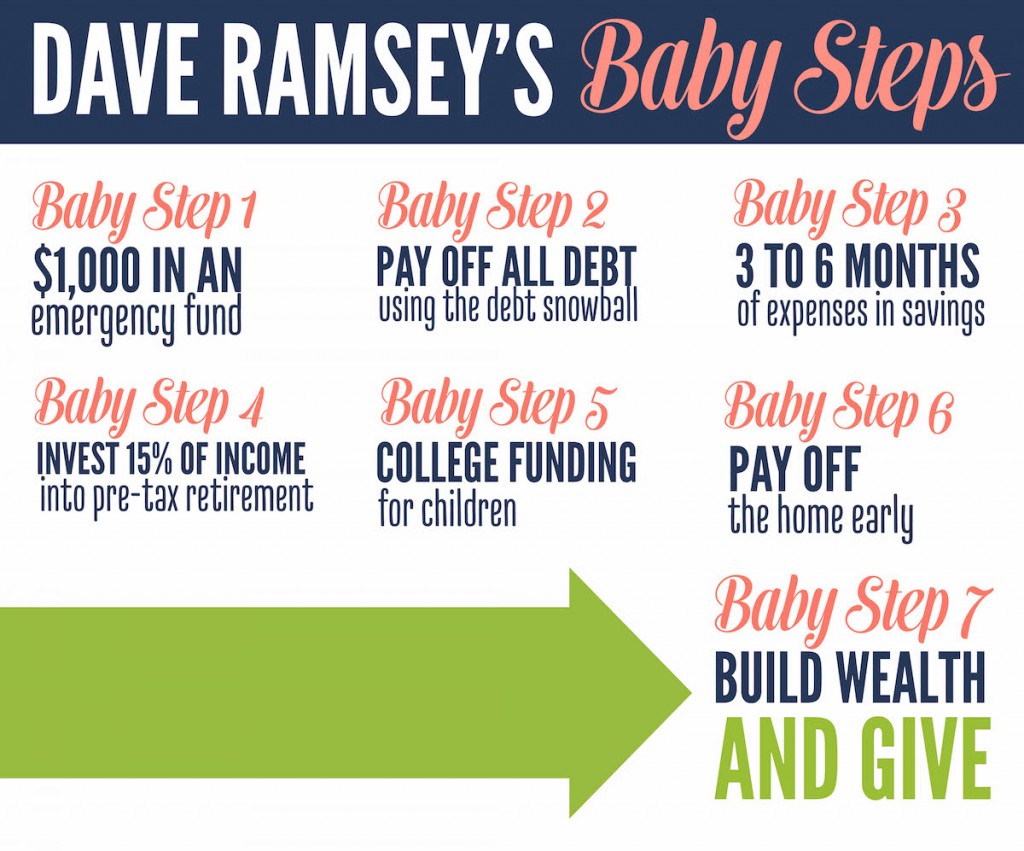

You can easily see Dave Ramsey’s Baby Steps on his website for free. The Baby Steps provide the rough framework for Financial Peace University; however, FPU goes into much more detail and provides a lot more guidance than the Baby Steps themselves. For example, one of the major topics in FPU is types of insurance that you should purchase. If you look at the Baby Steps, though, insurance is not mentioned at all.

I learned a lot from FPU. But the two most important takeaways that I got, and the reasons I think you should watch FPU, are: (1) creating a monthly budget and (2) saving up for big expenses so that you don’t have to borrow money.

Monthly Budgeting

The monthly budget is the most important tool you will have in getting your finances in control and working for you. Before taking FPU, Maria and I did not talk very much about our spending. Now we both create monthly budgets and sit down to discuss them at the end of every month. Actually, we will be doing our budgets for December this weekend. We calculate how much money we expect to receive, we project how much we plan to spend and how much we plan to save. And then we discuss it with each other. We ask questions to understand what the expenses are and make suggestions to help each other. Our discussions were longer at the beginning; now they take about ten minutes total.

Budgets change during the month as unexpected expenses happen and we adjust our budgets to those changes. But, by and large, we stick with our projections. I have been amazed at how much money I have been able to set aside for my sinking funds (which I’ll talk about next), even with paying down my debt as quickly as possible. The feeling of empowerment when I started actually seeing my savings account increase was incredible.

I’m a big nerd and like to do my budget in a program called GnuCash, which is a free open-source financial accounting program comparable to Quickbooks. Maria has been doing her budget in a Microsoft Excel spreadsheet for years. You will need to find what works for you to get started. I found that doing my first few budgets on paper worked best until I had a better feel for what my expenses would be. Since December is almost upon us, there is no time like this weekend to sit down and start getting your finances to work for you.

Sinking Funds

When it comes to big expenses, Dave loves sinking funds. Sinking funds sound complicated, but it’s just a fancy name for saving money up for an expense. I use sinking funds for a lot of my predictable expenses now. For example, I know I get a water bill every three months and it is usually around $120. So, for three months, I save up $40 a month for my water bill. That way, my checking account isn’t hit with a big bill; it’s spread out over a period of time.

You can create sinking funds for almost anything. I have sinking funds for vacation, my next car, auto repairs, gifts, and my insurance premiums. Once my debt is paid off, I’ll probably have more. Maria has a ton sinking funds: twelve in total. Her smallest fund is to renew her teaching certificate from the State of Michigan. Every month she sets aside $4. No recurring expense is ever too small for a sinking fund.

The sinking funds are great as they allow me to save up for big expenses so that I don’t have to borrow money or use a credit card to pay for those expenses. And even for the smaller expenses, its great to spread those out over the year so I don’t have a big hit to our expenses all in one month. My savings account hasn’t been this full in quite a while!

So Why Do I Love Financial Peace University?

There are lot of great things about FPU: it helps you get out of debt, it helps you put your money to work for you, it helps you be prepared for unforeseen accidents, the list goes on and on. But, frankly, the reason I love FPU is how much it has helped my relationship with Maria. We are always on the same page when it comes to money. I don’t think we’ve ever had a disagreement about finances; if we have, we quickly resolved it because FPU gave us the tools to do so.

Finances can often be a source of strain and tension in a relationship, especially when the couple is in debt. Dave repeats over and over again that he wants couples to take the strain of bad finances out of their relationship. Heck, it’s even in the name of the course: Financial Peace University.

I strongly believe that taking the FPU course before Maria and I are married is going to save the both of us boatloads of tension and frustration in our marriage. We’ve essentially nipped those problems in the bud before they affected our relationship in a major way. That’s why I will always recommend people take FPU before marriage, but it is also useful if you’ve been married for a while and want to right your financial ship.

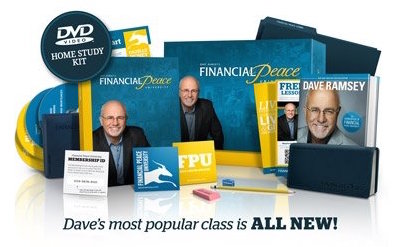

How to Get Financial Peace University

FPU Membership and online are slightly less expensive than the DVD Home Study Kit. If you prefer, many churches offer FPU as a group study by watching the videos and then working as groups on the FPU exercises. In fact, FPU is coming to Maria’s church this February. If you live in Macomb County, Michigan you can take the class there. Childcare and food will be provided. You can also find a location near you at DaveRamsey.com.

There are other ways to get started

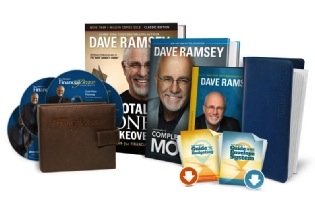

Next up the ladder is the Starter Special for $45, which has some more items that the Quick-Start Combo does not. Or, you could just buy Dave’s Complete Guide to Money book, which covers almost everything that FPU does.

Getting out of debt is wonderful and Dave Ramsey gives you the basic tools to do so. But beyond that, he has helped Maria and I address our finances so that we never have to worry about how we will handle our money. And for that, I highly recommend him.

Need Some Motivation on Your Debt-Free Journey?

Maria created a fantastic, editable and (best of all) free “On Our Way to Debt-Free” chart to help keep you on track. Just click the image below to get your copy!