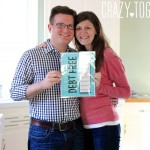

Maria and I have been working our butts off to pay off my $180,000 in student loans early and we are so happy to announce that we did it!

WE ARE FINALLY DEBT FREE!

We began our journey out of debt last summer, shortly after we were engaged. We invested in Dave Ramsey’s Financial Peace University Home Study Course and began planning our financial future together. It wasn’t the most glamorous part of our engagement, but those hours spent in the FPU program certainly help lay a solid foundation for our marriage.

We crafted an ambitious plan to pull ourselves out of debt in a year’s time and Maria created an On Our Way to Debt Free Chart to keep us motivated. She even created a customizable version of the chart for those of you who are on your own debt-free journey and need to visualize your progress – just enter your email address below.

The first payments were small and we colored in the tiniest of lines on the chart. We really started getting traction when I sold my house and we put the proceeds towards my debt. The next large chunk was paid from Maria’s home downpayment savings (which she’d been building for seven years) and brought us a whole lot closer toward our goal. Then, to celebrate July 4th and the end of our wedding festivities, we made one more large payment to bring us even closer.

We can’t wait to celebrate our independence from debt! Before heading out the door to see our family today, we proudly marked another $18,000 payment by coloring in our debt chart. We are getting SO close. Read the update in our blog, link in profile. Happy 4th of July, friends! #crazytogetherblog #goingdebtfree #4thofjuly #independenceday A photo posted by Maria and Rob (@crazytogetherblog) on

Now we have finished coloring in the debt chart and my student loans are kaput!

This whole journey has been quite the experience. After graduating law school, I just assumed that I would be spending the rest of my life in massive debt. As Maria and I logged in to my account to make the final payment, I noticed that I was originally scheduled to finish paying the loans in 2039! I would have been 55 years old!

Getting out of debt this quickly would never have been possible without Maria’s encouragement, patience, understanding and motivation. There are so many reasons I love my wife, and our journey out of my debt has illustrated so many of her wonderful qualities as my partner and as my closest friend.

To celebrate being debt free, Maria and I decided to break out the champagne from the Champagne Incident and create our first video. Take a look!

Financial Peace University Changed Our Lives

Our motivation and guide for getting out of my student loan debt was Dave Ramsey’s Financial Peace University. Because we love Financial Peace University so much and because we know it works, we decided to give away a DVD Home Study kit of Financial Peace University! Maria and I watched these DVDs and did all of the exercises together in the early days of our engagement. I can honestly say that because of Financial Peace University, Maria and I have never had a fight about money. Which is kind of crazy. No matter where you are in life, Financial Peace University can help you, too.

Our Debt Free Scream on the Dave Ramsey Show

When you successfully pay off $250,000 in debt (mortgage plus law school loans), you just have to shout it from the rooftops. Or, if a rooftop is not available, on a nationally syndicated radio show. On February 15, 2016; we did just that. The two of us drove down to Nashville to do a debt free scream on the Dave Ramsey Show. The experience was life-changing and the perfect way to close this chapter of our marriage and our lives. You can read all about that experience in this blog post. We even got the big guy himself to sign our Debt Free Chart!

Our Journey Out of Debt

If you want to learn more about out debt free story and our experience with paying off all that debt, you can click on any of the images below for more information. Thank you so much for all of your support and encouragement along the way!