Over the past few weeks, I’ve shared my story my story of how I landed $180,000 in debt and Maria told her perspective as she realized the debt would impact her life. Today, I am happy to reveal our plan to deal with the debt and begin our lives together debt-free.

Maria was the one to suggest that we watch Financial Peace University. I actually remember the moment pretty well. Maria seemed a little nervous to ask me; almost like she was afraid of offending me. Maria had already spoken to me a little bit about Dave Ramsey’s Baby Steps and I was tired of paying over $1,000 a month to my lenders, so I was interested in learning more. I also knew that finances were very important to Maria and that agreement on finances is key to strong relationship. So I agreed to complete the program with her. As we watched, we learned a lot together, engaged in some very meaningful conversations, and even had some tense moments when we realized we would have to make some sacrifices to achieve our goal of debt freedom. But, on the whole, the experience was a very rewarding process that brought the two of us closer together.

Our Plan

Phase 1 – Debt Snowball

The plan Maria and I put together has three phases. We are in the first phase right now, which is the straightforward debt snowball from Baby Step 2. I have two student loans, one for about $20,000 and the other for about $160,000. I am paying the minimum amount on the larger loan and I am throwing everything I can at the smaller loan since I can pay it off much faster than the bigger loan. I had been saving for retirement (a little bit, anyway), but I stopped doing that so I could focus on the loans. In the past few months, I have brought it down a little bit. I will continue this for the next few months and pay off as much as I can.

Phase 2 – Sell the House

Phase two gets even more ambitious. I am a homeowner. I bought my house in 2010 when the market was pretty much at its bottom. Since then, the value of my house has risen substantially. I will sell my house sometime this spring, and put the proceeds from selling my house toward payment of my student loans. That will pay off a HUGE portion of what I owe. Rather than buying another house, we decided that we will rent a house or a condominium for at least a year. It may seem crazy to rent for a year when we could be living in a house that we currently own, but we’re Dave Ramsey people. We make crazy decisions knowing that the future will be so much brighter once we are on solid financial footing.

Phase 3 – Repurposing Savings

Phase three is one of the main reasons Maria had a hard time with the reality of paying off my debt. Maria had been saving for a downpayment on a house for years. The rest of my debt will be paid off using money from a variety of sources, but the biggest chunk of it will be Maria’s house savings. This was a hard decision Maria made, but after a lot of discussion, we decided that it was the best course for us. Maria had also been saving 15% of her income for retirement, but those payments have halted as well. Like me, she is now saving every extra penny so that we can dig ourselves out of debt as fast as possible. We will resume our retirement savings later – just as soon as the debt is paid off.

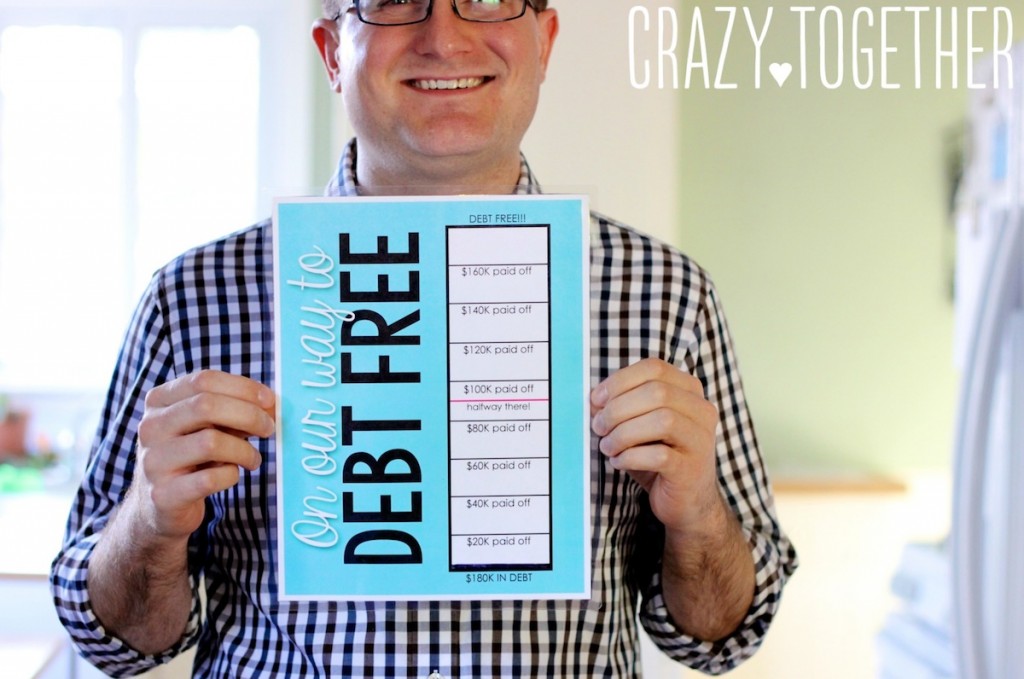

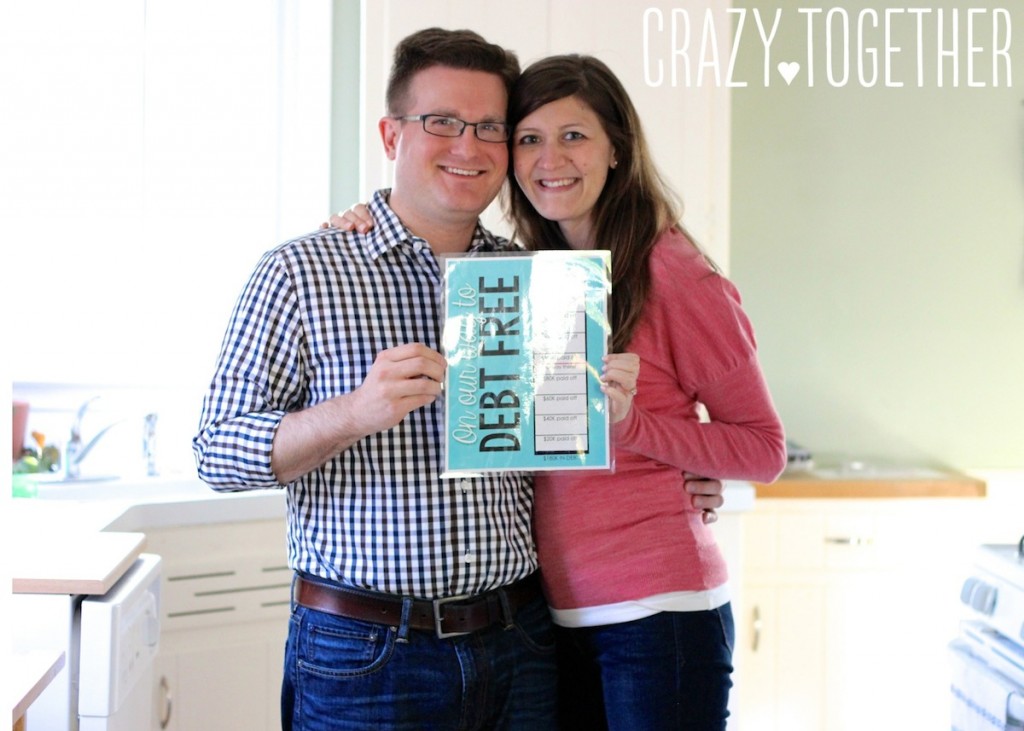

Free Download – Debt Payoff Chart

Ever the teacher, Maria created a debt payoff chart to help us track our progress and stay motivated as we work to pay off my student loans. This editable “On Our Way to Debt Free” poster is available as a free download. It’s a PowerPoint file so you can easily edit the graph to suit your own debt payoff goals. Click the image below to download your poster today and join us on our journey out of debt.

If you look REALLY carefully at the photos of us with the chart, you can see that I have already filled in a tiny bit of the chart. It took a few months to rearrange my finances and plan for upcoming expenses, but little-by-little, we are on our way to paying off my student loans.

After all of this, we will have to start over with our house savings. But, we will be doing it without any debt to slow us down. And we will be happy because we will have done it together, as husband and wife. We’ll get to our dream house one day and we’ll do it the way we wanted to, with a little help from Dave Ramsey and Financial Peace University.

Update: Debt Payoff Plan Complete!

Since posting this, Maria and I have completely paid off $250,000 in debt (mortgage and student loans)! It was a heck of a journey and we worked our butts off to do it together. After it was all done, we decided to head down to Nashville and do a Debt Free Scream on The Dave Ramsey Show to celebrate being debt free. You can read all about that and how we got to meet the man himself Dave Ramsey in this blog post.

Our Debt Free Journey

If you would like to read more about how we paid off my mortgage and student loans, click on some of the blog posts listed below.