Big things have been happening behind the scenes at Crazy Together. Now that Rob and I are married, we can finally put all of the plans we made for building our future into action. Yes, the wedding was beautiful, exciting and beyond all of my wildest dreams and expectations. Our honeymoon was also amazing and delightfully low-key and relaxing. We intend to share lots of photos from both of those events on the blog in the coming weeks. Today, however, I am so proud to share a story with you that is so much bigger and more important than a fancy wedding or a weeklong getaway.

If you are a regular reader of the blog, you probably know that Rob and I were facing some serious student loan debt from Rob’s law school loans. One hundred eighty thousand dollars worth of student loans to be exact. Rob was also a homeowner with a mortgage to pay, which put him even further into debt. Right from the beginning, Rob openly and honestly shared his experience with debt on the blog.

You may also know that I worked hard to keep myself free of debt for the past several years. The only debt I had ever incurred was an auto loan, which I quickly paid off within a few years and vowed to only buy used cars from that day forward and to pay cash in full. In the meantime, I worked hard, splurged on a few items for my closet, but for the most part I saved every penny that I could in the hopes of putting a healthy down payment on my first house. When Rob and I got engaged, we had to talk long and hard about our money and figure out how we could work together to chisel away at his mountain of debt.

We purchased Dave Ramsey’s Financial Peace University Home Study course and feverishly worked through several lessons each week. We absorbed every bit of advice that Dave Ramsey had to share and we used his philosophy to guide is formulating our own plan to dig our way out of debt. At first, Dave Ramsey’s plan was one that I did not want to hear. I had seven years of hard-earned savings in the bank, which I was planning to use as a down payment on my dream house. Instead, it became apparent that I would have to let that money go and use it to help pay down Rob’s debt after we were married. It was not an easy thing for me to accept at first and I cried tears of sadness and frustration as I realized that I would have to postpone that dream and build again. By now, Rob has learned that my way of coping in the face of adversity is first to cry, then to push through with fierce determination.

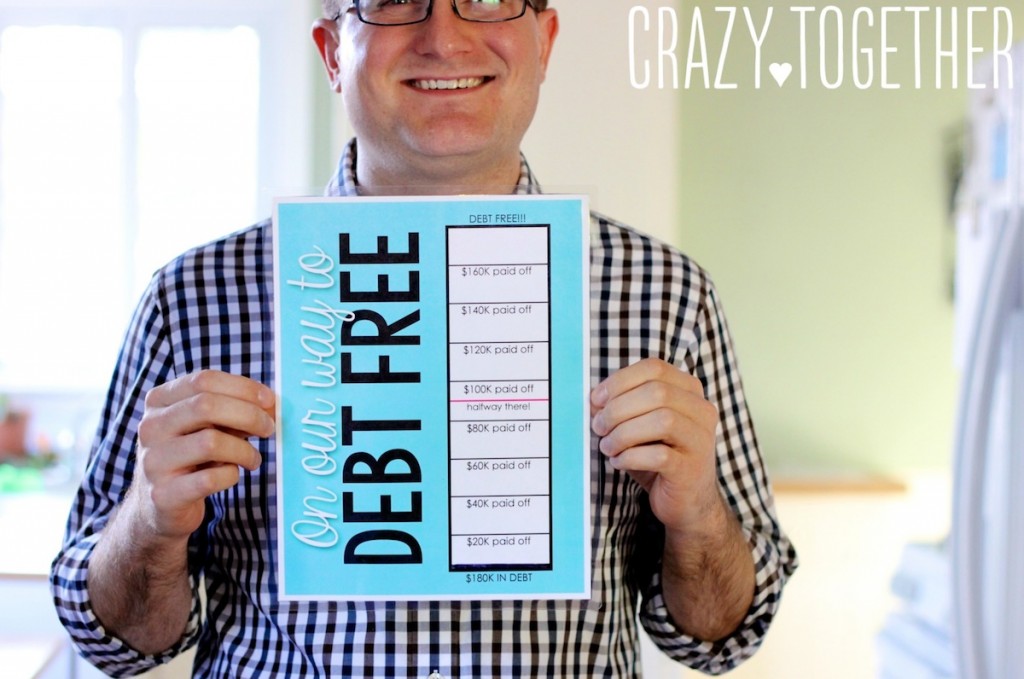

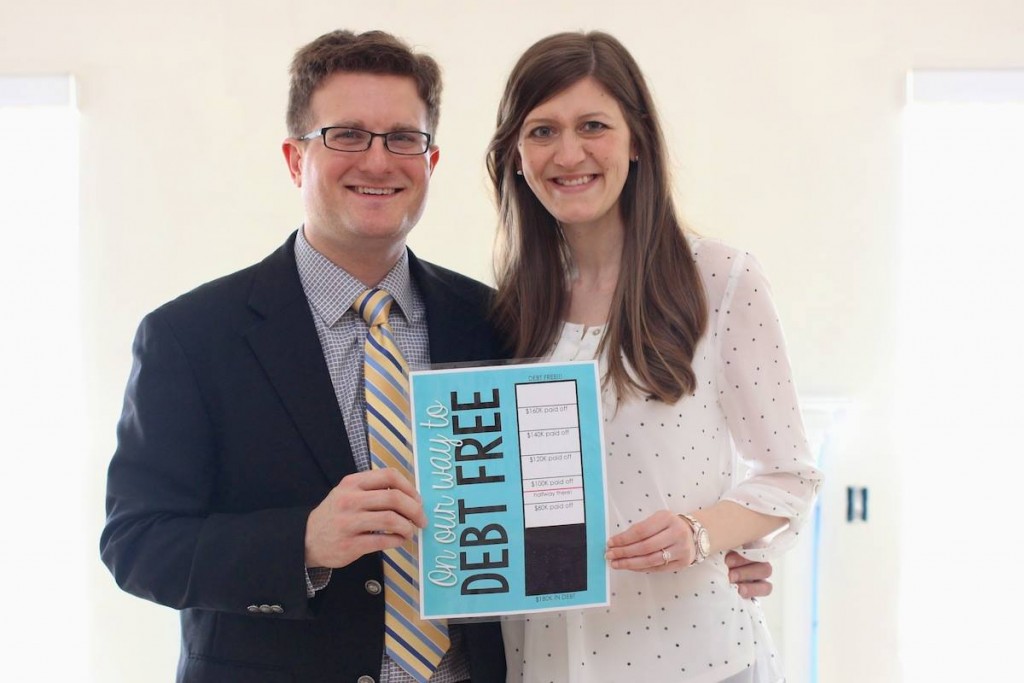

My first step was to devise a plan to keep both of us motivated and focused on the task at hand. I created a printable chart to help us monitor our progress in pulling Rob out of debt. I created a customizable version of this chart that you can download for free. Just enter your email below and it will be sent right to your inbox.

We posted the debt-free chart on Rob’s refrigerator in his house and it served as a constant reminder for our goals and the work we had ahead of us. Rob worked hard and cut a lot of corners to chip away at all of the debt. For several months, the progress was SLOW. Each time he was able to apply an extra payment toward his principal, we would color in a space on the chart to mark our progress.

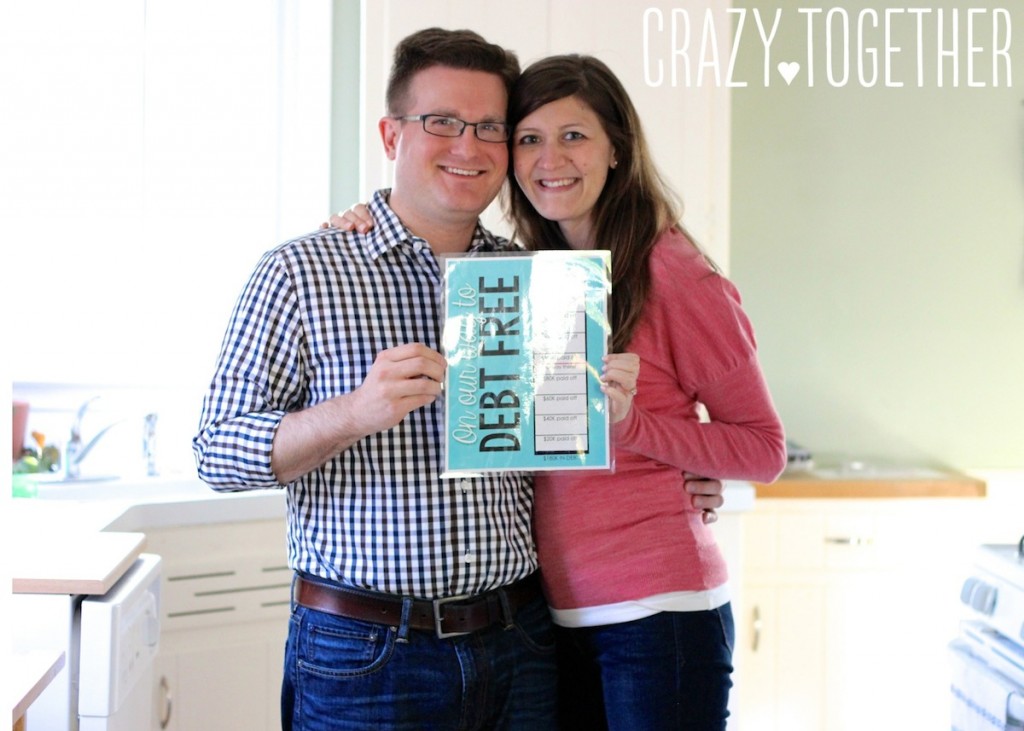

Rob made payments as often as he could and I kept saving with a new goal in mind: helping to pay off the debt as fast as possible after the wedding. During the engagement, Rob’s debt was not my responsibility (yet) and even Dave Ramsey would advise an engaged couple to keep their finances separate until after marriage. This was our plan and our unified goal, so Rob and I agreed to work separately in our plans of attack for the debt. In the meantime, we talked about our progress every week and dreamed of how our lives would look when they were finally free of debt.

Since it was our plan and our progress forward, I always hopped in the photo with Rob after we colored a space on the chart.

For the first several months, our progress was painfully slow, but we colored in tiny slivers of the chart each time Rob took steps toward paying his debt down. In April, we had our first BIG step forward when we sold Rob’s house. He had purchased the house after the bottom dropped out of the housing market, scored a great deal and the house had slowly been building equity over the past few years.

We found a great condo to rent for our first home and were thrilled to finally color in a significant chunk on our debt free chart, thanks to the proceeds from the house sale.

In the weeks before the wedding, life was crazy and we weren’t making any visible progress in our goal to tackle Rob’s debt. But the chart still sat on the new refrigerator and served as a reminder about our goals. The day after the wedding, we logged in and made a $90,000 payment toward his student loans.

So where did the money come from? Not our wedding gifts. If you’re connecting the dots, you probably already figured out that the payment came from my savings. Seven years of saving for a house, plus an additional year of throwing every penny that I had to spare into savings for the sake of paying down Rob’s law school debt. A few people have asked me how I felt about using so much of my hard-earned money to pay down such a huge loan that I had nothing to do with.

Here is my very honest answer to that question.

I was actually a little nervous about it. Yes, I was completely on board with the plan and I knew it my heart that it was the best course of action for our future together. But I was also nervous that there would be some small, selfish part of me that would feel the pain of letting so much money go and have a less-than-positive emotional response to the situation. Leading up to the wedding, I was genuinely excited about making such a huge payment and taking such a huge stride forward. Rob and I would sit and talk like a couple of little kids about how amazing our wedding would be and how truly awesome it would be to make real progress forward on our financial plans. We honestly were equally excited for both events.

The day after the wedding, we sat down at the dining room table and got out Rob’s laptop. He logged in to his student loan account and linked it to my bank account. We were so close! He entered in the payment amount ($90,000!) and clicked “submit”. Thankfully, I didn’t have a single adverse reaction to the event. In fact, I immediately wanted to color in the chart. Life was truly crazy and we were so busy running around and tying up loose ends from the wedding, we decided to wait until the next day so we could truly enjoy the moment of coloring in our debt chart. The next day, after things had calmed down, we got out the Sharpie. And I watched in excitement as Rob colored a HUGE space on our debt chart.

A photo posted by Maria and Rob (@crazytogetherblog) on

Then we grabbed the camera, went outside and posed for a photo!

With only $30,000 to go (I know, that sounds crazy that we are saying it’s only $30,000), we are so close to conquering the first of many financial goals! We actually have a good chunk of that money still sitting in our savings account from my original savings, but we want to make sure all of our wedding and honeymoon expenses are settled before we give all of our financial cushion to the bank.

You’re probably wondering what we did with any of the money we received as wedding gifts. I couldn’t bring myself to use a single dime of the money people gifted to us to use as payment for Rob’s law school loans. It just doesn’t seem right! Rob and I have different plans for that money, which we hope to share with you in the coming weeks!

One last thing! If this story sounds too good to be true, I promise you it is not. We were faced with so much crushing debt, being able to see the light at the end of the tunnel is such a relief! Left to our own financial plan, we would have spent my savings on a house we couldn’t afford and would still be saddled with $180,000 in debt. The plan Dave Ramsey lays out in Financial Peace University sounds crazy and backwards from what society teaches us to do, but his logic, math and foundations from the Bible are sound. Rob and I feel so deeply contented about our finances because of the program and we highly recommend FPU to anyone that is frustrated about their finances or just looking for reassurance that they are on the right track.

Note: This was not a sponsored post in any way. We didn’t even include affiliate links in this post. Rob and I just really believe in the value of Dave Ramsey’s philosophy and the financial plan he outlines in FPU!

Update: We’re Debt Free!

Since this post originally published, we finished paying off a grand total of $250,000 in debt from Rob’s student loans and mortgage! To celebrate our Financial Peace University success, we went on The Dave Ramsey Show to do a Debt Free Scream in February 2016. You can read all about it in this post and hear our impressions of the man himself, Dave Ramsey.

Our Debt Free Story

You can read more stories about how we paid off my student loans and mortgage by clicking on any of the images below.