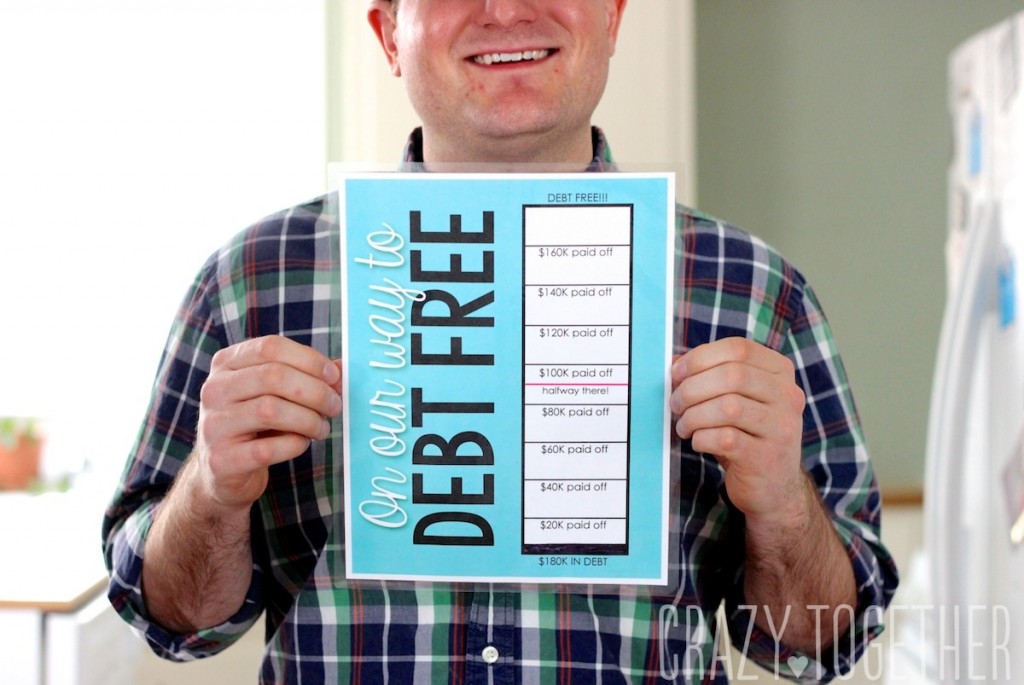

Yesterday was an exciting day for Maria and I: we got to draw another line on the “On Our Way to Debt Free” chart! Each line we draw on the chart is a little over $2,000 paid off and we now have two lines on the chart! That means we have over $4,000 in principal paid off! I know that’s tiny compared to the $180,000 I owed in total, but that’s pretty good progress for six months.

I know you can barely see a difference from the earlier photo. Like I said, $4,000 is tiny compared to the $180,000, but we are moving forward! Here’s a zoomed-in photo so you can actually see our current progress.

Maria and I started this plan in July of 2014 and the debt payments are not the only thing that we have been working on. There have been a lot of changes behind-the-scenes to our finances. I already talked about how we save up for expenses. I now have fourteen different funds; including auto repair, clothing, gifts, home improvement, insurance premiums, license plate renewal, medical, new car, vacation and water bill. These savings are expenses I would have anyway, but now it doesn’t hurt when I get hit with a big bill. I already have the money saved up.

The other major change is one that, hopefully, we will never have to use. Maria and I now have life insurance and disability insurance. I never used to care about those sort of things … until I met someone that I want to spend the rest of my life with. Let me tell you: life insurance and disability insurance take a massive load off your mind when it comes to a relationship. We don’t have to worry about finances if, God forbid, something were to happen to one of us. There are plenty of other problems in life; worrying about how we will afford daily expenses in the face of hardship should not be one of them.

If you are wondering where we got that beautiful chart to help motivate ourselves, I’m proud to say that Maria made it. You can download an editable copy here by clicking on the image below.

In case you are new to the blog, you can read all about how Rob got into debt, Maria’s perspective of Rob’s debt, and how Dave Ramsey’s Finance Peace University helped us create a plan to eliminate Rob’s debt.

The steps out of debt seems small now, but it’s more progress than I have ever made and it will only go faster from here on out. Here’s to a wonderful start of our lives together!

Debt Free Update

We are so happy to share that we successfully paid off all of the debt in August 2015 and we appeared on the Dave Ramsey Show on February 15, 2016.

You can read more about our debt-free story by clicking on any of the images below.