The Christmas season is mostly over (though I’m sure we’ll leave the decorations up for a little while longer so Dessa can continue to enjoy them) and we are looking ahead to the New Year. We always use this time to reflect on the past twelve months and to focus on our goals for the year ahead. Maria and I don’t get caught up much in traditional resolutions, but this is our favorite time to work on goal setting for our future. Most of our biggest goals in years past had a financial focus and this year is no different.

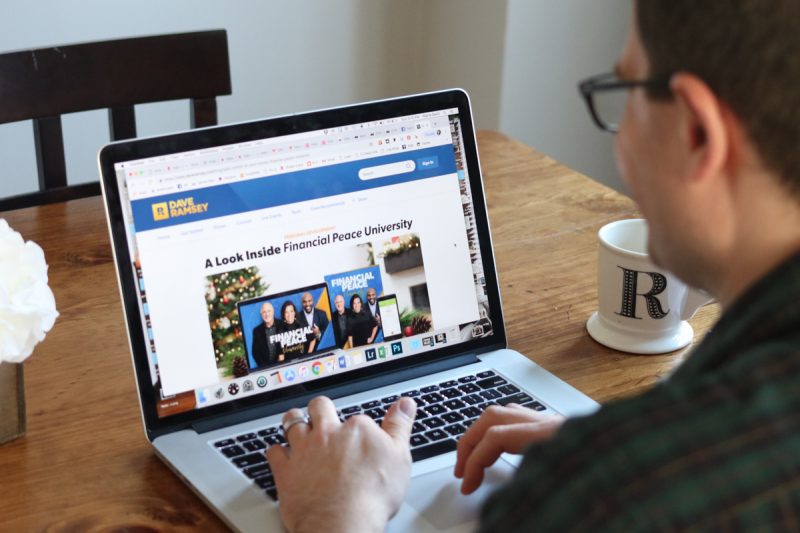

For the past several years, Dave Ramsey’s financial advice has served as our guidepost as we look ahead and plan for the future. Maria has long been a follower of Dave Ramsey and she introduced me to his financial wisdom shortly after I proposed to her in 2014. As part of our marriage preparation, we watched Dave’s comprehensive Financial Peace University videos together. I am a practical man and Dave’s simple, straightforward advice was hard to ignore, so I became a follower, too.

Dave has seven simple Baby Steps towards financial freedom. FPU teaches you what those Baby Steps are and how you should work toward them, including one of the most important items: monthly budgets. Working on our monthly budget isn’t always easy or convenient (especially now that we have a toddler in the house), but Maria and I always make time to discuss our finances and it’s one of the most important tasks we accomplish every month.

Since we started, we’ve followed all of Dave’s financial principles and have reaped the benefits:

- We paid off my $180,000 in student loans

- We saved a significant down payment (66%!) for our new home

- We consistently overpay on our 15-year mortgage monthly payment

- We paid cash for a new-to-us minivan when the transmission went out on one of our vehicles

- We created a significant emergency fund that saved the day when our water heater unexpectedly died

- We set up and contribute monthly to our retirement fund and Dessa’s college savings fund

- We set time aside every month to review our monthly budget and create a financial plan for the month ahead

After we hit our first financial milestone and dumped all my student loan debt, we drove down to Nashville to do a debt-free scream live on the Dave Ramsey Show. It was one of the most exciting moments of our marriage.

We follow Dave Ramsey’s advice throughout the year and are slowly working our way through the Baby Steps. Our short-term financial goals and needs continue to shift each time we achieve a new milestone and we often find ourselves reviewing our Financial Peace University course materials to reference the next step in our financial journey.

We recently sat down to figure out what our financial goals for 2019 should be. In the end, we came down to two things. First, we hate being in debt again (even if it is the mortgage for a home home that we absolutely love), so we decided to work hard and aim to pay off an extra $10,000 of our mortgage principal this year. We already overpay monthly, but we’ll have to dig even deeper to achieve this goal. I’m certain we can do it. And this is on top of all the ongoing goals we’ve already set for ourselves and continue to follow through on, like doing monthly budgets and saving for retirement, college, and Dessa’s wedding.

Second, we decided that we needed to watch Financial Peace University again. Like any complicated subject, a refresher course for personal finance is always good practice. And we just discovered that this is the perfect time for a refresher because Dave Ramsey and his team have released an updated version of Financial Peace University. So we made our New Years resolution to watch the new FPU course videos and make sure we are still doing everything possible to keep ourselves on solid financial ground for our family’s future.

Maria and I are excited to watch through the new FPU courses, not just because we want to check out the updated content, but because there are quite a few new extras included that we haven’t tried out before. Along with the courses and the workbooks, members get access to:

- Smart Money, Smart Kids, which is Dave’s program for teaching financial basics to children. We were gifted this book from a like-minded friend after Dessa was born and it gave us great insight for the years ahead, but I’m particularly excited to watch the new videos in this series as we start teaching Dessa how to manage money.

- A subscription to Every Dollar Plus, Dave’s budgeting app. I have a feeling that Maria and I will keep using our spreadsheet, but I’m really curious to try the app out.

- The Legacy Journey, which is Dave’s Bible-based program for planning the financial legacy you will leave your family after you pass. Dave’s Legacy Journey book was already on our list of financial resources to look into one day and we’re excited to gain access to the bonus content Dave created on this topic in FPU.

- Access to financial coaches, an online community, and updated content throughout the year.

With these changes, FPU is moving from a one-time purchase model to an annual subscription-based model. The cost is $129 for the first year and $99 every year after that, but you can cancel at any time for no fees.

When we first started down this path, our primary focus was getting our finances in order and ridding ourselves of debt to finally create a little … well, peace with the way we handle money. Now that we are parents, the lessons learned from Financial Peace University are even more meaningful because they have a direct impact on Dessa’s life and future. The ability to stand on solid financial footing is truly an incredible blessing for any family and Dave Ramsey isn’t kidding when he says it will change your family tree.

Because Maria and I are so incredibly thankful that a friend started us on the Dave Ramsey path so many years ago, we want to pay it forward and share the gift of Financial Peace with one of you. In celebration of the upcoming New Year, we are giving away a one-year subscription to Dave Ramsey’s new Financial Peace University! Use the Rafflecopter below to enter. We wish you the best of luck!

a Rafflecopter giveaway

This post was not sponsored by Dave Ramsey and it doesn’t contain affiliate links. We are just incredibly thankful for all we have learned through Financial Peace University and the solid financial footing we gained by his advice. The program truly is life-changing and we are gifting a membership to FPU with our own money to one lucky follower who is ready to “live like no one else!”

And just in case you’re wondering, Dessa isn’t always this cooperative and adorable when we sit down to work on our budget. We often try to squeeze in budget conversations while she is down for a nap, but she hears us discussing our budget and personal finances on a daily basis. We believe it’s healthy and important for us to model financial responsibility for Dessa in the home. She won’t be ready to balance a checkbook any time soon, but she will quickly come to know the importance of living within her means, saving regularly, and giving generously.

To up our retirement savings percentage to 15%!

That’s a good one! We’re there now, but I feel like we are behind the ball because I dragged us down with my student loans. I hope we can bump it up once we pay off the house.

We’re saving in multiple areas. I’d like to pay off our house quicker while continuing to save in our other areas.

That’s exactly where we are! Baby Steps 4, 5, and 6 all kind of coincide, along with other things we want to save for. It’s like you’re being pulled in more than one direction at a time.

We also have a 15-year mortgage that we put a significant down payment on and pay extra towards each month. I wish we’d learned the power of a 15-year mortgage when we purchased our first home in 2005. At least we had it figured out by the time we bought our current home 4 years ago! It’s so satisfying to watch that principal continue to go down each month.

It really is satisfying to see that drop in principal every month! And it’s alright, I figured it out late, too. Happy New Year!

We are debt free, but I know we waste so much money on little things. We need to do the difficult task of finding those trouble areas and doing something about it, together.

That is a good goal. It’s so easy to spend a lot of money on small things that really add up.

Our new year’s resolution is to get better about spending and budgeting! Thank you for all your advice and wisdom!

You’re welcome! Thanks for reading!

We’re hoping to buy a new “almost forever” home in 2019!

Nice! What makes it “almost forever”?

One of our biggest financial goals will be to cut our food budget and avoid wasting. Our toddler is also dairy free which makes things a little more complicated.

I feel you there. Groceries and restaurants are where we often exceed our original budget and have to revise. And the dairy-free does make things a little more complex, but fortunately not as bad as some other dietary restrictions. Good luck!

I’m hoping to work on becoming debt free.

Good luck! It’s a fantastic goal and totally worth the effort.

I started my debt free journey a couple of months ago after my birthday. I’ve got some lofty goals for next year and your story is inspiring! Thank you!

You’re welcome! Good luck on your own debt-free journey!

I’m am looking to work on my finances this year!! I want my student loan debt gone! You guys are inspirational!

Nice! FPU can definitely help with that. Getting rid of those loans was one of the most freeing feelings I’ve ever had.

Looking forward to a budget friendly year in our house and paying down more debt!

Hear, hear!

I took the Ramsey course years ago, and I was able to get out of debt. I need a refresher! Now married with car loans, our goal for 2019 is too pay off debt!

Hooray! My car loan was the first loan I paid off and it was fantastic. Good luck!

We just had a baby so we stopped everything while I was pregnant. We are hoping to finish up the last of baby step 2. It was so hard to stopping when we had such momentum, but I’m glad we took Dave’s advice and saved our $ because we had some unexpected expenses and we didn’t have to worry about where the money was coming from. That Dave knows what he’s doing :)

He sure does. And there are so many unpredictable things when it comes to babies and finances, so it’s best to be prepared.

Your family is such an inspiration to me for financial responsibility and sensible, reasonable living! Thank you so much for all your good financial and parenting advice – and the Stitch Fix posts are pretty fun, too!

You’re welcome! Thanks for reading!

We want to identify our problem areas and see where we can eliminate waste. Start our journey to become debt free!

Good luck! FPU is a great place to start!

How exciting! We are just getting started on our Dave journey & would love to win this. We have only read the book so far.

We absolutely love FPU, so we love to share it. Good luck!

I have seen several friends start this and I have been intrigued. One is to pay down my student loans. They are hovering over me for way to long.

I can’t recommend it enough. Getting rid of my $180K in student loans was liberating.

We did FPU 10 years ago before we got married. It was amazing for us and we still do monthly budgets! Our mortgage is the only debt we have, but we both want to be debt free again! In 2019 (next month!) we plan to have a serious budget review to find areas where we can cut spending to put more to our mortgage. We plan to be “gazelle intense” which is definitely a phase that has stuck with us.

While I’m bummed to hear that there is a recurring fee for membership, we would love a free year too see updated material, review tips for kids (we currently have 2 under 2!); and use the course to help regain our focus to improve our financial freedom!!!

Yeah, the annual membership fee was something that I wasn’t sure of at first, either. But the more I thought about it and the ability to cancel anytime, I felt more ok with it. Good luck paying off that mortgage! We’re really focused on that, too.

We were gifted a FPU course as a wedding gift 17 years ago, but have not followed the principals for the last few years. Time to rebuild our emergency fund…

Yeah, it’s something that you can definitely fall off the wagon on. But you can always get back on. Good luck!

I’m looking forward to making our money work!! My husband and I have great income, but, we don’t know where it really goes-besides mortgage, car payments, student loans, and private school tuition for our children. It would be awesome if we could budget and stop wasting money!! I’ve even contemplated using the envelope system. Finished reading Dave’s “The Total Money Makeover”, so FPU is the next step! Happy New Year Rob, Maria, and Dessa!!

We basically need to start from square one with organizing our finances. We aren’t hurting for money, but also aren’t managing it smartly. We had intended to hire a financial planner but maybe this course could be what we need! Will it help us to learn also how to manage assets like rental properties or investments/stocks?

Rental properties, no. Dave does have some basic advice regarding investments, but he doesn’t get into a ton of nitty-gritty in FPU. Personally, I think you should do FPU to help give you an over-arching plan for all your finances and then hire a financial planner for your investments specifically. Maria and I have a financial planner for our retirement savings and Dessa’s college savings because we don’t know enough or have the time to manage them ourselves.

This is the year for us to get serious. I’ll probably have a similar amount of student loan debt after I finish grad school next year, and with 6 kids, we need to start on a better foundation.

Phew, I feel that pain, but six kids does add a whole new wrinkle that Maria and I did not have to deal with. Good luck!

I’m hoping to finish paying off my debt and start a 3-6 month emergency fund!

Good luck! It gets even more fun when you can see your savings increase with all the money that had been going to your debt.

We are working on paying off student loans!

I hear that. Good luck!

So, about 18 mo ago I found your blog and commented because I was confused about what a sinking fund was. We were deep in a heap of consumer debt and just learning the Ramsey basics. We are now on BS 4,5&6, I’m an FPU coordinator, and have absolutely changed our minds and lives when it comes to finances! Thanks for your support…even if it was just replying to a comment. Giving away a FPU membership is wonderful, I’ve seen the new videos, they are great!

One note, I’m not sure if it was clear in your post. People who have previously purchased FPU can Always attend an FPU class in their area without a new membership. They will get to watch the new videos in class and get the group support that is such a wonderful component of FPU. Of course to get access to EveryDollar, and all the other content I think the membership fee is totally worth it!

Wow, that’s awesome! I’m pretty sure I remember that comment, so I’m super happy to hear your debt-free journey is complete (except for the house) and that you’re on to Baby Steps 4, 5, and 6 and are spreading the word as a coordinator! And I’m glad you pointed that out, as I actually was not aware of it. Thanks!

Paying off credit card debt!

Good luck!

Paying an extra months worth of our mortgage! Saving for medical expenses for another baby!

Great goals! Good luck!

One of my goals is to figure out how to travel now that I’m retired without racking up credit card debt. I was completely debt free when I retired, but have developed a habit of charging travel expenses and then have a difficult time paying them off in full with my smaller budget

Good luck! The temptation to use credit cards is one of the reasons we don’t use them. Maria cut hers up when we did FPU back in 2014 and I’ve never had a credit card.

Moving onto baby step 3 by July is a major goal I have set this year. I also was thinking that a FPU refresher would be useful. You guys are such a huge inspiration!

Good luck paying off that debt and wrapping up Step 2! And thanks so much, we love sharing our story and hope it helps other people.

If I remember correctly from your old blog posts, you don’t do cash envelopes. Have you ever talked about how you’ll show Dessa how the concept of money works (getting a paycheck, taking out cash, using a debit card, etc) since there’s so many methods of currency transfer nowadays? We don’t even have a bank account with a brick-and-mortar bank so I don’t think we’ll ever be taking our kids out to the bank unless it’s a school field trip or something.

We don’t do the envelopes, but we do use cash for our grocery and restaurant money. Maria and I haven’t decided 100% yet how we’ll teach Dessa to do that, but I’m sure we’ll change some of our habits to provide her with a good example.

Some of our financial goals are to pay more towards our mortgage, add a garage, and put in more money for retirement. However, my husband works for the federal government and are not quite sure when the shut down will be over, so it would be nice to have some money saved. We have also never been on our honeymoon.

Those are all good goals. We’re planning to save for adding a garage to our house, too (though not this year). And you should definitely save for your honeymoon! I hope you’re able to go.

We are self employed and ready to simplify our lives. We plan to sell one of our buildings and use the money to pay off debt. We also plan to sell our home and move to a smaller home closer to work. Our daughter will be starting college in the fall, so we will continue to save monthly to pay for her tuition. We have huge financial peace plans for 2019 and continue to pray for God’s guidance.

That’s a lot! Good luck with all of that!

Would love to gain some control over the finances.

The only debt my fiance and I currently have is our mortgage, but my goal in 2019 is to stop spending so much unnecessary money. I love shopping but I feel like I have so much STUFF and I could contribute so much more to our savings.

That’s a great goal!

We didn’t realize there were new video lessons and new extras for FPU. Our church is starting FPU again this month so I think we will rejoin.

For 2019 financial goals we are going to save up private school tuition for 2020/2021 for our 2 boys (to put in 529 accounts for Virginia tax deduction), pay an extra $10k on the mortgage principal (balance is still over $300k ugh), save $5k toward a new car that will be needed in the next 2 years, and somehow go see my parents in Europe for my dad’s 70th birthday this summer (estimating at least $10k to fly 4 people, rental car, accommodation, side trips, party and present). My husband and I are also doing 10% into our 401k each.

Lofty goals and we will see what we can squeeze out of that budget to get there!

That’s a lot of goals! Work hard and I bet you can get there. Good luck!

My financial goal for 2019 is to work harder at helping my husband with our finances. Partly because he’s a control freak =) and partly because it’s my least favorite “household chore” I have let him run our finances our entire marriage. We did FPU the month after our wedding, because we knew that money is a big issue with most married couples, and he took to it like gangbusters while I basically yawned my way through and tried really hard to pay attention! I’m a words and emotions girl, he’s the numbers and logic guy. I know this stresses him out, though, and it’s one of the things that we argue about, so for our marriage’s sake I know I need to learn more about saving and budgeting and paying attention to our financial health.

The new FPU videos may really speak to you Sara! They have a lot of first hand accounts and interviews from people that are working the Baby Steps, instead of just Dave on stage. As an FPU coordinator, I think It’s a lot more engaging for the “free spirits” in the group!

That’s great to hear!

My husband and I are just trying take the first steps in getting out of debt and becoming more financially knowledgeable!

FPU is a perfect place to start, then. Good luck!

I’d love to cut down on our eating out and use (and not waste) all the groceries we buy!

Yeah, waste can be a problem. We’re getting better, but still have a ways to go.

I would like to start budgeting and saving more consiously, with a plan and goals. This would be so helpful!

FPU is perfect for you, then!

We are going to pay our house off this year!

Awesome! Congratulations! We can’t wait for that day to come.

Thank you for sharing information like this. The hardest part for me is making the monthly budget. I am trying hard to eliminate debt and look forward to the peace and new opportunities it will bring.

Monthly budgeting can be hard at first, but it’s the foundation for everything you need to do financially. Good luck!

We’ve had a really rough two years. Emergency travel for a parent dying, our car giving out, major surgeries for myself, a flood in our house…You name it and it happened. We couldn’t catch a break. We’ve depleted our savings and need to start everything anew! A fresh start in a new year is just what we need!

Wow, I’m so sorry you went through all that. Hopefully, 2019 will be a much better year for you. Good luck!

Love your blog. Maria’s writing introduced me to Dave Ramsey. I finally convinced my husband that getting out of debt need to be a goal. You are both a blessing!

Thank you so much!

Our goal this year is to get out of debt. We just paid for a move cross country and the purchase of a new home that we thought our finances could handle. Both ended up costing way more than we budgeted for and we quickly ran through our savings as well. We have some work to do and have decided we will never be in this situation again.

I can only imagine how much that all must have cost. As Dave says, keep that gazelle-like intensity as you work through your journey. Good luck!

Our goal is to get out of debt and start seriously saving for a house.

Great goals! Good luck!

a new year’s resolution for my husband and I is to make and stick to a budget!

The monthly budget is the basis for everything in FPU, so that is definitely a great goal. Good luck!

My goal is to increase my emergency savings up to 6 months of expenses and pay off my car loan this year!

Both are great! My car loan was the first thing I paid off back in 2014. It was my first real taste of how awesome getting rid of debt is.

I’d love to start an emergency fund….it’s the one thing our family lacks and I think it would bring some much needed peace of mind

You definitely should. The lack of worrying about money really frees you from a lot of stress.

I need to start and build up my emergency fund and also stay on budget.

Those are good goals to have. The budget is the key to making your money work for you. Ever tried the envelope system? You take out cash for each of your budget categories at the beginning of the month, stick it into an envelope for that category (like one for groceries, one for restaurants, another for gas, etc.), and spend only the money in each envelope for the month. Once it runs out, you can’t spend any more in that category. It really drives home how much you spend in a month and makes you stop and think about each purchase.

We would like to start our journey to becoming debt free and I think we need this course to learn how to do so. It’s been amazing watch you both paying off huge amounts of debt. It has inspired us to believe that we can do it too!

FPU is great for helping teach you to get through your debt free journey! And I’m really happy we’re able to inspire you. It’s why we share our story. Thanks so much!

I’d like to up our retirement savings to at least 10% if not more and continue to pay down the principal on our home. We pay extra each month but need to up it. Lastly we are working on being more intentional with our “extras” and would so benefit from a monthly budget that we stuck to. No debt except mortgage – but we have three little ones and could be way more mindful and intentional with our finances.

We are in dire need of working on our student loan debt. We will be re-reading your older posts on your financial journey.

Save up for a great vacation.