Surprise: we’re buying a house! Believe me, it’s nearly as big a surprise to us as it is to you. But, when one of the cutest houses in our area went up for sale, we decided we just had to go for it and make an offer. From there, everything just fell into place and we are thrilled to share that we will become homeowners in just a few short weeks. Here’s the whole story of how we unexpectedly decided to purchase the perfect house for our little family of three. Dessa’s still a little shocked by the whirlwind story so if this feels like unexpected news, you’re in good company.

Our Financial Path to Home Ownership

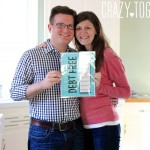

Owning our own home has been one of our primary goals since we became a couple. However, it’s always been a seemingly far-off goal as we waited to get our financial house in order. Using Dave Ramsey’s Baby Steps as our guide, we’ve slowly been working our way towards the goal of home ownership. If you’ve been reading the blog since we were engaged, you probably recall that our early finances were overshadowed by $180,000 of student loan debt, which we paid off with a lot of hard work, savings, and by selling my old house. Our Debt-Free Scream on the Dave Ramsey Show was a moment we will always cherish.

Once the debt was behind us, we turned our attention toward the future by building up our emergency fund, saving for retirement, starting a college saving plan for Dessa, and finally beginning to save for a down payment on our forever house. We’ve been renting (first the condo and then our current home) as we saved money for that down payment. Needless to say, owning a home has been a dream deferred for a little while.

Until now. For the past several months, Maria and I have been discussing our plans for the future and what we need in a home. Now that Dessa is crawling, things are starting to feel a bit cramped in our small house. Our current lease is up in August and we decided in mid-February to just start looking casually for a house in the Royal Oak area that fit our price range. We figured we had plenty of time before August, but it wouldn’t hurt to start looking early.

A couple weeks into our casual search, Maria noticed a for sale sign on one of the really well-kept houses that’s only a few blocks away from the house we’re renting. We asked our agent about it and she let us know that it had just been re-listed after a purchase fell through. We did a walk-through that night and instantly fell in love. The house was built in 1925, has been very well maintained and updated, fits both of our styles beautifully, and still has some unfinished areas that we can expand into later. We made an offer on the house two days later and held our breath until the homeowners accepted our offer the next day. In 72 hours time, we went from casually searching for a house to entering a contract. It happened that freakin’ fast.

Deciding to Purchase a Home

Not that we made the decision to start looking for a house lightly. We’ve actually been debating what to do for several months. We went back and forth between “toughing it out” and staying in our current home, which we adore but are starting to outgrow; purchasing a starter home entirely with cash; or using our current savings as a significant down payment on a forever home and getting a mortgage to cover the rest.

When we walked inside of the house we intend to buy, it was too good to pass by and we carefully decided to take on a mortgage and put ourselves back in to debt. Ugh, I know.

After working so long and hard to get ourselves out of debt, the thought of taking on a mortgage is not one that we love, but we are optimistic and we have a plan to pull ourselves back out as quickly as possible. We are still following Dave Ramsey’s advice when it comes to purchasing a home with a mortgage. Dave recommends a fifteen year, fixed-rate mortgage with the monthly payment being no more than 25% of your take home pay. He also advises home buyers to put down at least 20% of the purchase price. Well, we are in good shape in each of those areas. In fact, we are putting down almost 66% of the purchase price on a fifteen year mortgage! Our monthly mortgage payment (including taxes and insurance) will be smaller than our current lease payment, which leaves extra room in our monthly budget to put additional money toward the principal each month. And we are going to work our butts off to pay off that mortgage within a few years.

A Little Bit About the House …

Now for the fun stuff: what is the house we’re buying like?! Well, its definitely bigger. The new house is about 1,400 square feet (compared to the 950 square foot space that we currently occupy). It has three bedrooms and two full baths (though one is in the basement and Maria swears she will never, ever step foot in the “dungeon” bathroom). The new house is also a bungalow style and the upstairs was remodeled into a very nice master bedroom with a large closet (yay!). For now, we plan on using the second floor space as an informal living room. The kitchen is GORGEOUS, with soft-close cabinets and drawers, butcher-block counters, and all new appliances. There is a lovely dining room with a chandelier that we can’t quite agree on whether to keep or replace. Even with all of the updates, the character of the house still shines through. It has french doors, original wood floors, original trim and a few quirks that you can only find in home that’s over 90 years old. My favorite space is the living room, which has a beautiful gas fireplace with original built-in bookshelves to either side. I foresee many nights of curling up by the fire with a book and a drink and my favorite girl. The fact that our new house is located right in our current neighborhood, which we have grown to love immensely, is just the icing on the cake.

We are scheduled to close on the house on April 9 and we have a few small projects that we intend to take care of before we move in, but they shouldn’t take long. From small stuff like adding electrical outlets, to bigger things like finishing the closet in the master bedroom. We are planning to move near the end of April, once those projects are complete. We are so excited about this next chapter in our lives and we can’t wait to share photos with you in the coming weeks.