If you’ve read Crazy Together for any length of time, you already know that Maria and I love to save money. But, we’re people, too, and I’m sure you have noticed by now that there are also several areas of our budget that we indulge and allow ourselves splurge on. The key for us is that we are choosy about what we splurge on and, once we’ve prioritized only those items that we truly care about, we budget for them. Spending a little more money on clothes, food or housing isn’t necessarily a bad thing, as long as you set aside enough of your income to pay for it and aren’t spending more than you earn.

Just like everything else, the key to spending responsibly is to plan for the expense and factor it into your monthly budget, rather than going on an impulse spending spree. After all, everyone deserves to indulge a little bit. Here’s a quick breakdown of the areas of our budget that we choose to cut back on and save a little money, so that we have the flexibility to spend on the categories that really matter to us.

This post contains affiliate links. We earn a small commission each time someone make a purchase through one of our links, which helps to support the blog.

Things We Save On

So how do we afford the nice things that matter to us? By cutting corners in other areas of our budget. These are mostly things that just aren’t that important to us. It’s kind of a yin and yang of our financial life. Here are a few of our favorite ways to cut back and make a little extra room in our budget each month.

Cable

This is an easy one that most other people already save on to afford nice things: we don’t have cable TV. Maria and I weren’t watching it much anyway when we cut the cord a few years ago and we honestly haven’t looked back since. And who needs cable TV in the age of Netflix, Hulu, and Amazon Prime?

Car Payments

We also avoid car payments by not having a car loan. Rather than getting a loan for a new-to-us car, Maria and I save money for a car and pay cash when the time comes. And we don’t buy new; we only buy used cars. I paid off my only car loan ever back in 2014 before we were even engaged and I’ve loved not having that monthly car payment ever since. Thanks to a high rate of depreciation for new vehicles, it is much cheaper to purchase a used car and paying in cash saves us interest on a loan or increased lease costs.

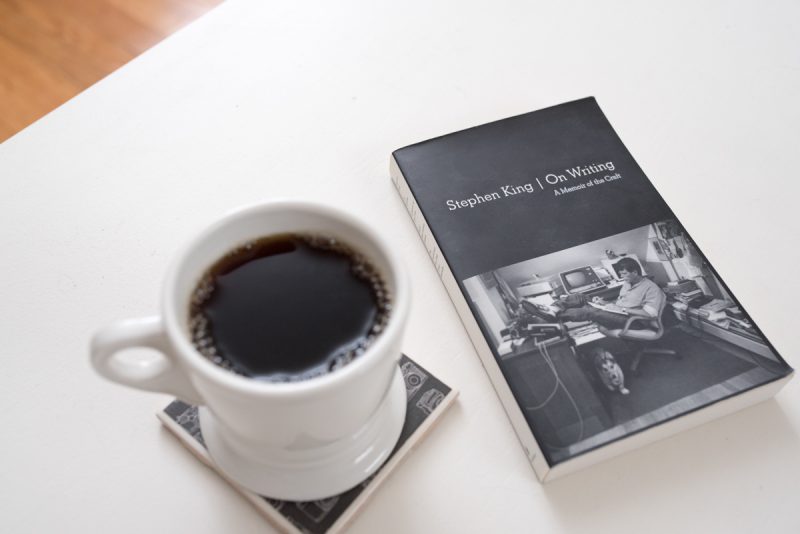

Books and Audiobooks

I read a TON. I always have at least one or two ebooks that I’m reading and I there is always an audiobook loaded on my phone for when I’m in the car. On average, I probably listen to two or three audiobooks a month and read two or three books a month. That’s a lot of reading. If I were to buy all of those through Amazon and Audible, that would cost us at least $1,000 per year in audiobooks alone. So, rather than buying all those ebooks and audiobooks, I get most of them from my local library. OverDrive and Hoopla are great resources most libraries participate in and the savings really helps us be able to afford nice things. I also have been gifted a Scribd subscription for audiobooks, which is more affordable than Audible and has ebooks to boot.

Clothes

Clothing is a bit of a complicated category for us. We almost exclusively purchase new clothes, but Maria and I are both pretty picky and only buy those items of clothing we know we’ll wear. We make sure we absolutely love a clothing item before we choose to purchase it and you can read how picky Maria is about her clothing purchases in her monthly Stitch Fix reviews. Maria even is able to sell some of her gently used clothes on Poshmark and all that money goes right back into our clothing budget.

For Dessa, even though we buy mostly new clothes, the vast majority of Dessa’s clothes are simple pieces bought on sale from Carter’s and Old Navy. Maria watches those sales like a hawk and most of the clothes in Dessa’s closet have been purchased for 40% to 50% off. It also helps that we keep Dessa’s wardrobe pretty minimal; with a handful of basic tops and bottoms that easily mix and match, a few seasonal dresses, and basic accessories that go with everything in her closet.

Vacations

If Maria and I are going on a vacation, we like it to be extra nice, but high-end vacations and getaways are not something we can easily make room for in our budget. So we plan smart and typically only go on one or two vacations a year. Sometimes the only way we can afford a nice thing like a vacation is to get all of the luxury in a small dose, so when we say vacation, we usually just mean weekend getaway. This past fall, our family went on our first vacation as a family of three to Mackinac Island and it took us over a year to save up for two-night getaway. If we have enough room in the budget to tuck $100 away for our next vacation, we figure we are doing pretty good, and some months we only manage to save $25 toward our vacation fund.

Toys

We’ve talked about why we don’t buy lots of toys, but it has another benefit for us: it saves us money. On top of not buying many toys, Dessa’s favorite toys are by far some of her simplest and least expensive. She with her stuffed dogs and her blocks over and over again without a complaint. Heck, on Valentine’s Day we got Dessa a custom photo book full of pictures of her with dogs and a balloon. Guess which one she loved the most? Hint: it was inflatable.

Hair and Nail Care

Maria saves a bunch on these two by basically only going to the salon a few times a year. She doesn’t color her hair and has a system of growing her hair out until she can’t stand it anymore, then cutting off several inches to update the style and doing it all over again. Her haircuts are pricey, but the expense isn’t so bad when she only goes every 4-6 months. As for nail care, Maria only treats herself to a manicure or pedicure on special occasions. Otherwise, she paints her nails with her new favorite, long-lasting nail polish. If hair and nail care were really important to Maria, we would find a way to make room for it in the budget and cut corners somewhere else. But she finds a way to make it work for her, and I really appreciate the small sacrifice so that we can enjoy being able to afford other nice things together.

Entertainment

Honestly, this is one area where Maria and I are trying to make more of an effort at enjoying life. We save a lot on entertainment mostly because we never really get out. Maria and I are homebodies and we often just focus on taking care of Dessa, the house, and the blogs. By the time the day is done, we’re happy to watch some TV, unwind a little bit, and go to bed. And when we do get out, it’s usually just a walk downtown for dinner and a trip to the park, or a short drive to the zoo (our zoo membership remains one of our favorite Christmas gifts because it provides endless entertainment and is free for us to enjoy), all of which means we don’t get out much right now since it is so cold. Now that the weather is starting to show signs of improvement, we will probably resume our neighborhood walks and trips to the zoo in the near future.

Home Furnishings

It has been nearly a year since we purchased our home and if you followed along with our home updates, you know that there are a number of furnishings and home decor accessories that we would like to update or add to our home. Honestly, we expected to have made more progress in transforming our home by now. We even still have a modest “home furnishings” sinking fund that we could use to purchase a few items on our list right now if we wanted to. Purchasing new furniture and home decor isn’t necessarily something that we intentionally seek out to save big, but it turns out that delaying gratification is a huge money-saver for our family. We aren’t running out to the store to fill every empty space of our home with new furniture, which has helped us to continue gradually saving over time so that we will easily be able to afford the pieces we truly love when the time feels right.

Things We Splurge On

What’s the purpose of cutting corners on areas of our budget that don’t matter much to us? So that we can afford the nice things we really love! Here’s a look at the luxuries Maria and I spend more on than we really need to:

Food, Glorious Food

Oh man, do I love me some really good food. Delicious food is probably my biggest weakness. I love to eat. Often, one of my earliest thoughts of the day is beginning to wonder and plan what will I have for dinner later that evening. So I love to eat and food will always be something I love to spend money on.

Maria and I regularly spend more than we originally budget for groceries and restaurants in a month. We always adjust our budget to compensate, but it’s a common situation. The biggest reason we overspend: we buy a lot of organic food. Probably the next biggest reason is eating out. We don’t eat out a ton (maybe once a week), but we get somewhat more expensive food when we do. Even our “fast food” dinners tend to be higher-end: like Chipotle and Panera Bread.

Heat and Air Conditioning

Maria and I have reached a compromise when it comes to the temperature of our house. I have always loved a cold house. Growing up, my parents’ house was a steady 68 degrees, day in and out. Maria, on the other hand, had grown accustomed to warmer temperatures ever since she rented an apartment that offered free heat all winter long. Over the years, we have settled in at keeping the house around 72 degrees during the day and turning it down to 67 or so at night (we both love sleeping in cooler temperatures). It makes for some expensive gas bills in the winter and high electric bills in the summer, but we want to be comfortable in our own house and we’re willing to pay for it.

Clothes (Yes, Again)

Yeah, I know we listed this one up top as an item we save on, but we also spend a decent portion of our monthly budget on clothes. It’s not that we buy a ton, but that we buy good quality clothes for ourselves. And the better the quality, the pricier the clothes. Another factor is Dessa. Toddlers grow quickly, needing new clothes frequently. Maria does a great job of shopping around for great deals on Dessa’s everyday clothes, but we generally dress Dessa in new clothes (rather than secondhand) and it’s not uncommon for us to splurge on an especially nice dress from Matilda Jane or Sweet Honey Clothing.

Vacations (Yeah, These Again, Too)

We may not vacation often, but when we finally do head out of town, we really like to treat ourselves to an exceptional experience. When we have finally managed to save enough money for a special getaway, Maria spends hours poring over vacation destinations, trying to find the nicest accommodations with a special twist on hospitality. Our first anniversary getaway to the Wickwood Inn in Saugatuck, MI was a relaxing retreat in the comfort of the best B&B that we have ever seen and a trip that we still dream about.

Then last year, when we were ready to embark on our first trip as a family of three, Maria turned back to the computer in search of the best toddler-friendly accommodations on Mackinac Island, and we treated ourselves to a two-bedroom family suite at Mission Point Resort so we could have a separate room for Dessa (which meant better sleep for us) and the three of us had an amazing time on the island. Anytime we go on vacation, we look for accommodations that are every bit as comfortable as our home and we spend more to make it as luxurious and fun as possible.

Lawn Service

I have no problem cutting the lawn. Well, I guess that’s not quite true; I usually have no problem cutting the lawn (I used to put it off a few days occasionally when I was single and living in my old house). But it takes up a solid hour or two on a weekend and I often don’t have that kind of time to spare. Weekends are my chance to catch up on our finances and responsibilities for the blog. It’s also time that our family can enjoy together. I don’t want to spend my limited family time mowing the lawn, so we pay for a service to cut it for us. The amount of extra time it buys me every week is well worth the cost.

Computers

Maria and I live on our computers. And I mean that in both the literal and the figurative senses. My career as a lawyer is extremely dependent on computers for writing and research and our blogs (heck, the whole internet) wouldn’t exist without computers. And since we spend so much time on them, we have really nice computers that run efficiently with very few bugs. Maria has a fully loaded 2015 Macbook Pro 15″ laptop and I have the Dell G5 laptop, which serves my blog and business needs quite well, and has the added benefit of being a quite nice gaming computer if I want to unwind at night. I also have a 2012 Macbook Air, which has seen better days and I pretty much use only for blogging at this point.

So there you have a more complete picture of our financial lives. We can afford the nice things that really matter to us by saving money in other areas to do so. And no matter what, we make sure that we properly budget for those expenses. By following Dave Ramsey and budgeting right, we aren’t depriving ourselves. We’re just being smarter about how we spend our money and not spending more than we earn. I am curious to know what other areas people prefer to splurge in. Go ahead and share yours in the comments!